Budgeting can be so complicated, can’t it? It seems like every week there’s some new budgeting software, app, or tool that is being recommended, and we go off and running to test it out only to end up frustrated and not liking it. Over-complicating things or hopping around trying different systems can really do damage to your budget if you’re not careful. Once you find a budgeting method that works for you, there’s not really any reason to switch except in one single case. If you’re finding that your budget is more involved and complicated than what you need, then and only then would I recommend a complete budget overhaul to move toward what I like to call, The Simple Budget.

Budgeting doesn’t have to be complicated. We’re the ones that make it that way. Budgets at their core are nothing more than simple math and math is one of the few things in this world that never really changes. A simple budget can keep things nice and easy for you without making your head spin with numbers and percentages. After all, a simple budget is better than no budget!

How To Make A Simple Budget

Disclosure: This post may contain affiliate links to Amazon and/or Etsy, which means that I may earn a small commission from some of the links in this post. Please see our Disclosure Page for more information.

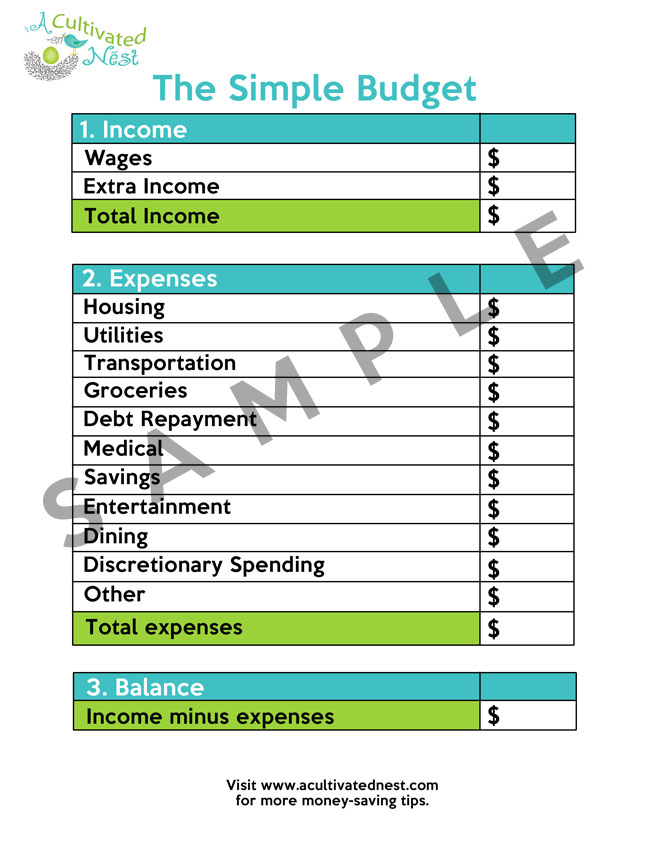

The Simple Budget only needs you to record three things; income, expense categories, and balance. That’s it! So simple right? To get started print this free Simple Budget Work Sheet at the bottom of this post, or make your own on a piece of paper.

For the top area, you’ll add any income that you have for the month. This will include earnings from your regular job, freelance work, or any income that you can count on. Don’t forget a single penny. Once you’re done adding all of it in, total it up. Whatever number you come up with is the amount of money you have to work with for the month. Nothing more, nothing less.

Now you’re going to list your expenses by category. Move down the sheet as you list them and try not to forget anything. As you do each category, make sure to put in the amount of money that you expect to spend for the month. Some categories, such as Housing (rent or mortgage), Transportation (car payment, car insurance, bus pass) and debt repayment will be fixed amounts. Others like Utilities ( water, electric, gas, phone) may be expenses that change from month to month unless you are on budget billing. You can estimate expenses that aren’t fixed by looking at your receipts for the past 6 months. For example, total your electric bill for the past 6 months and then divide that amount by 6. That will give you an average monthly amount you spend on electric. Once you’re done, total up all your expenses. Then subtract your expenses from your income and be sure to use the last box to record that amount.

Now, here’s where things can get kind of tricky. Are you in the positive or negative? Look at the total expenses you have. Are there more expenses than income? If so, you need to reduce your expenses or increase your income (check out ways to make a little extra money). Go back through your list and see where you can cut some spending. Check out all the money saving tips on this blog for ideas.

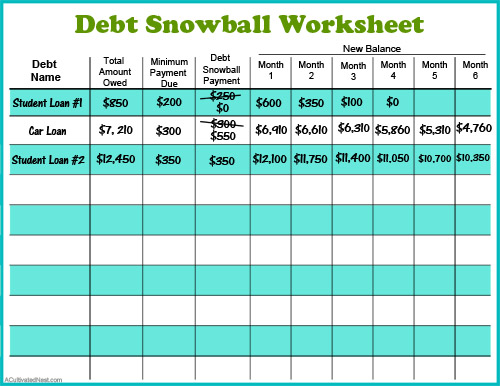

If you have more income than expenses, great! Budget the difference to add to your debt snowball or put it in savings!

As you go through the month, be sure you keep your expenses updated. If not, you’ll almost always end up spending more than you intended to. At the end of the month, take a close look at things. Did you over spend some place? If so, make sure to keep a closer eye on that category the next month and pretty soon your budget will be in tip top shape!

This is a very simple, basic way to budget that may not be for everyone. If you would like to create a more detailed budget please click here for How To Make A Budget Binder.

Click here to print The Simple Budget Free Printable Worksheet.

You may also be interested in: Free Printable Debt Snowball Worksheet