Hi everyone! Just popping in to let you know about 2 financial challenges that are starting in January that you might want to join in on.

First, there’s 31 Days of Living Well & Spending Zero

Disclosure: This post may contain affiliate links to Amazon and/or Etsy, which means that I may earn a small commission from some of the links in this post. Please see our Disclosure Page for more information.

at Living Well & Spending Less. There’s also a closed facebook group that you can ask to join for support in this challenge.

Most people are doing it in January, some people are doing it in February since it’s a shorter month, but really you can do a no spend month anytime it works for you!

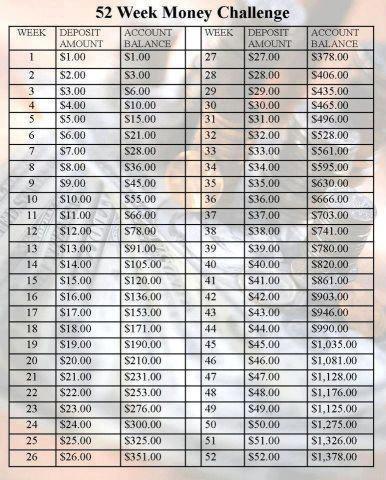

Then there’s the 52-Week Money Challenge

The idea is simple! Every week you deposit that number of the week into a jar or savings account. Week 1 you save $1, week 15 you save $15, on week 52 you deposit $52 for example.

*I have no idea who originated this idea or the chart-thank you!*

Some people do it in reverse- $52 for the first week ending with $1 on the last week (might be easier on the budget since it ends in December). Some people even do an “alternating” plan. One week it’s a low amount the next week it’s a high amount, then back to low, back to high etc. Just cross off the amount as you do it.

Here’s an open 52 Week Money Challenge Facebook page if you’d like support doing this challenge. There are probably others but this one isn’t closed.

Will you be participating in any of these challenges?

I don’t usually do a challenge, but I do set a budget for the year, so this sounds like fun. Hugs, Marty

How interesting. I wonder if it would be missed… We sometimes feel as if we’re scraping pretty close to the bone as it is.

Well you could try it – no harm in trying. If it works it works and if not that’s ok. I know some people are selling items on local facebook garage sale pages or ebay to come up with the $ for the 52 week challenge. Or sell some books you no longer want to read on Amazon.

I did the 52 week one this past year, except that I started with $52 and when I got down to $10 I just kept putting $10. I have used about 1/3 of it for Christmas this year, including supplementing our income because my husband is off for the week between Christmas and New Years without pay. I’ll be doing it again in 2014.

Yes, I think it’s easier starting at 52 and ending up smaller at Christmas. But really I think whatever amount people decide is good because it gets you in the habit of saving which so many need help with.

I don’t know if I will participate, but I did see the savings chart on Pinterest and was fascinated by it. I sent it to my daughter to take a look. Thanks for the tips and all your lovely posts Manuela, Happy New Year!

I’m only familiar with the 52 week calendar plan.

I haven’t joined anything or signed up officially.

I was just going to do it on my blog.

Do you HAVE to join?

Otherwise I will just do it privately.

Also– when I saw it I initially thought it better to do the countdown and reverse it, starting with 52 first. But then I remembered how side tracked I get and just divided it out and decided I’d do $26.50 a week!

That way I don’t have to keep up with so much! … cause lets face it… I need it to be as easy as possible to REMEMBER! lol…

THANKS FOR POSTING THIS REMINDER.

Pat

Oh…and HAPPY NEW YEAR TO YOU AND YOURS Manuela. 🙂

No you don’t HAVE to join but you might find extra motivation and some tips in being part of a group.

Happy New Year to you!

I love both challenges! I am trying to find the plan that is the right balance for me this year. I love a challenge. I’m competitive like that, even when (or mostly when) I’m competing with my own self.

Sounds doable!!

Happy New Year!

Judy

I did this last year (backwards) but decided this year to just save $25 a week, sometimes $30. Easier for me.