How To Make A Budget Binder.

This is my summer of organization! I know most of you are thinking summer is the time to relax and take it easy. I plan on doing that! But I also think summer is a good time to do a little organizing since I do have more free time and I will have more hands available to help me did do some projects. So my first project was to re-organize our budget (you’ll find out why as you read on) and I made a household budget binder! I also have a list of free printable financial planning pages at the end of this post that I will frequently update. Read on to learn how to make a budget binder for yourself!

Disclosure: This post may contain affiliate links to Amazon and/or Etsy, which means that I may earn a small commission from some of the links in this post. Please see our Disclosure Page for more information.

I know that most people set up a basic budget in January for the year. I always did. There’s nothing like a shiny New Year to get you motivated to make changes and be more organized!

The only problem I realized is that, for my family at least, I would often have to re-do our family budget mid year because my husband’s company has our medical insurance running June – May and every year the options get worse and the cost is more! It’s also the time that our mortgage company re-evaluates our escrow account for taxes which affects our mortgage payment. I never know how these two things will go! Sometimes things stay pretty much the same and sometimes, like this year, we’ll be paying close to $200 more per paycheck for medical (plus a high deductible) starting June. Yep, an extra $400 a month!! I almost cried when I saw that!

So now I’m going to try setting up our basic budget from June-May and see how that works. We’ll continue to re-evaluate it each month and tweak it as necessary.

I know it’s “old school” to use pencil and paper but that’s how I like doing it. I have tried other budgeting methods. Some people keep their budgets in an Excel spreadsheet, some use online programs like Mint or YNAB, some use Quicken, some use the envelope method (click here for a detailed description of how this works) and some people don’t care and do nothing and it all works out for them… or not 🙂

I would say do whatever method that engages you and really makes you aware of your spending and saving. I’m not completely old school…I do pay all the bills that can be paid online and I use Quicken as my check register and just download our transactions every day. (you can get Quicken here)

Don’t miss a post! Get this blog delivered by email. Subscribe via email here

How To Make A Budget Binder

This is how my budget binder is set up. My household budget notebook is a 1 1/2 inch binder with various free budget printables from different places on the internet which are linked at the end of the post. It contains:

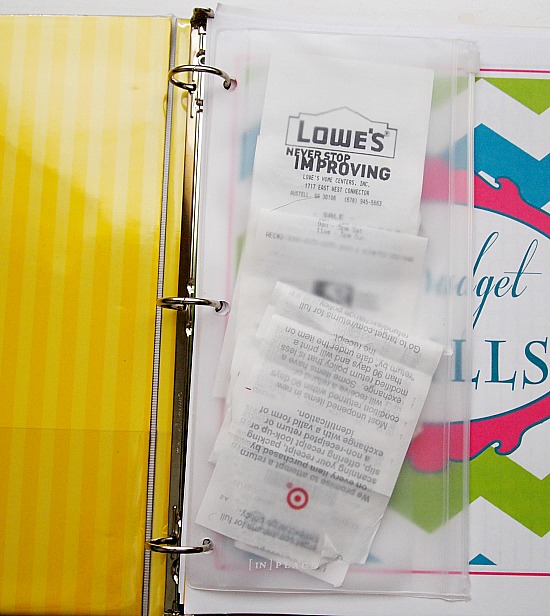

1. A vinyl binder pocket for receipts that need to be filed. That way they don’t accumulate in a pile on my desk. You may want to keep stamps, address labels, pencils or something else in it (or skip it altogether). You may also want to use a larger one and put your bills in it as they come in.

2. A monthly calendar. I use free printable calendars. There are lots of designs to choose from online. When a bill comes in or I have an automatic deduction, I write it on the calender a few days before the due date. I pay 99% of our bills online so paying a day or two before the due date has been fine for us. If I was mailing checks I would pay at least 5-7 days before the due date to make sure the payment was received on time. As the bill is paid I check it off (including automatic ones – I check my account online to make sure it was deducted – things happen). At the end of the week I make sure everything for that week has been checked (therefore paid) & entered in Quicken (including automatic savings deductions which are taken from our main checking account twice a month).

3. Debt tracking sheet – a place to list debts that have a monthly balance. Every month I enter the new total due and get excited watching the amount go down!

4. Annual Expense sheet to keep track of those expenses that happen once a year and then break them down into a monthly cost for budgeting. For example: Termite Bond Renewal, AAA Membership, Warehouse Club Renewal Fee, Membership/Subscription Fees, Property tax if it’s not included in your mortgage etc.

5. Total Income & Expense worksheet with Financial goals for the year. That way you can see where to cut if you have more going out than coming or if you have certain financial goal you want to reach. I normally only do this once or twice a year or if there are significant changes to our income or our expenses.

6. Monthly budget planner pages divided by monthly tabs. I keep the projected income for that month minus projected expenses for the month (it’s really pretty much the same every month – there are variable income worksheets linked below if your income fluctuates). When I’m really on top of my game we use the envelope system for groceries, eating out, and personal spending. If I’m not on top of my game (it happens 🙂 ) I do a weekly budget just on a sheet of lined paper to keep track of groceries, entertainment, gas, personal spending money etc. that I budget a weekly amount for.

7. Some people might want to keep check register pages in their planner but like I said, I use Quicken plus I rarely ever write checks. Some people might want to use cash tracking pages if they use mostly cash.

8. You may also want to keep a sheet to track your savings. Especially if you are saving for a specific purpose.

Use whatever budget sheets apply to your needs in making your budget planner. That’s what great about this system. You customize it to what works for you. This is what works for us, but I’m always tweaking and re-evaluating my system as should you. Things are constantly changing and as things change so should your budget.

Here are some places for free budget planning sheets to help you get started. If you offer some on your blog or know of others, leave the url in the comments and I’ll add it to this list. I’ll keep updating this list as I find more free planner pages so be sure to bookmark this post to see any changes.

Resources for Free Printable Budget Worksheets

How to Budget an Irregular Income

Living Well Spending Less Beginners Budget Worksheet

Paycheck to Paycheck Budgeting Form

Freebie Finding Mom Free Printable Income & Expense Worksheet

Dave Ramsey Monthly Cash Flow Printables

Pinch A Little Save A Lot 8 Editable Financial Printables

The Accidental Okie Free Budget Printables

The Uncluttered Lifestyle Financial Planner Pages

About.Com FrugalLiving Free Budget Worksheets

The Chic Crafter Household Monthly Budget Pdf

Free Monthly Expense Worksheet

Colorful Monthly Budget Planner from DIY Home Sweet Home

30 Handmade Days Printable Planner Pages

Twenty63 free budget printables

You may also be interested in:

How to Make a Grocery Store Price Book

Manuela

I enjoyed your post today. I have never used a budget. We always had endless funds until about a year ago when the economy in our line of business hit the crapper. Now I need to follow a budget more closely. Thanks for the links I am going to takeaway look and start a planner. I like writing it down too. I hate sitting at the computer for stuff like this. Now if its photo editing or blogging that’s another story.

Thanks Dawn! I feel I do too much stuff on the computer anyway with the blog and all 🙂 To me writing it down on paper makes it feel more real. I always felt disconnected – like they were just numbers when I used online programs. But I’m sure other people don’t have these issues!

This is a great tool! I had a budget notebook – ordered from a company long ago. It was so complicated neither of us wanted to use it. I like the simple way your notebook keeps you organized. I’m going to check out all the printables and see what my sweetheart thinks would work for both of us. Thanks for sharing this.

~Adrienne~

Thanks Adrienne! So glad you’re going to try it again. I like making my own because somethings don’t apply to our situation and sometimes there are things you want to track more intensely. So this way you an personalize it to your situation.

LOVE IT!!!!!

Thank you! Also, thank you for making the free printables available!

Sorry about the ins. increase – that is a big jump. I had increases in all my ins. this time around also, but fortunately not that high. I am another one that prefers to pay bills and keep records/lists, etc. on paper, and after my computer was stolen a while back, my thinking was reinforced. One of the first questions the police investigator asked was – did I do my banking, handle personal/financial/medical records, etc. on line and if so was any of that info. on the computer.

Have a great weekend.

Good point! Hopefully people that keep their records on their computers also back up their stuff. But it scary knowing that someone could access your info on your computer. So many browsers store your passwords and sign ins.

Great ideas! I’m trying to go through bills to see what can be reduced and of course always trying to get the grocery budget down. That is a bummer about your health insurance. Health insurance is a big budget buster at our house too. But sure was glad to have it when dh had his knee replacement surgery.

Yikes! Well my left knee is getting worse instead of better so that may be down the road for me too.

Loving your post today! I love doing things with pencils! I loved the links as well, as I just have the time to look on the internet, even with Pinterest. I am going to follow you on Pinterest, too!

What a great idea! My husband uses Quick Books, but I need a “hands on” type. I love this idea! Thanks for sharing this! Have a great weekend!

Hi Manuela!

Great post just when I was needing some encouragement of sticking with the budget! We are also needing to relook at things due to 2 kids needed braces at the same time. We are looking at paying $300/month for the next 2 1/2 years for the braces. A couple of years ago we switched from our health insurance savings plan to Samaritan Ministries, a health care sharing co-op. We found that even though we were paying thousands of dollars in medical bills each year we were never hitting the deductible and when we did it was for things not covered when we had the regular insurance. Now we pay around $350/month directly to another family in need and pray for them. Then we submit our big medical needs and always ask for a cash discount for our regular doctor visits, blood work, etc. It was so nice to get encouraging cards from complete strangers when I was sick and on bedrest two years ago. Samaritan Ministries may be something to look into to see if it will work for your family or not. They have a website. Thanks again for your post and lovely blog!

I am pretty old school …I have a huge notebook and I just write down a record of the bills as paid that month. ( mostly good for comparing your gas or electric bill to last years, that sort of thing…but also keeps on track as a backup. Ever forget to record the check in the register? Well you see in the notebook that you did pay the garbage bill on such and such a date )

Record checking when I balance it in the back of the notebook.

There is something about paper or seeing things in front of you ! 🙂 When I had alot of CC debt I started an excel spreadsheet and began to record my payments and seeing it shrink over time was so helpful!

Your article is interesting…you are a few steps more organized than me ! 🙂

I have always been the budget person in my home. I’m about to live alone again and will be doing new budget soon. I like paper and pencil myself! Great printables! Thanks for joining TTF this week.

Linda

Lately I feel so disorganized. These might just be the thing to get me going! Thanks!